Shima

0 comments 25.06.2015

One of the first questions I always ask my clients is, “Have you already been qualified?” I’ve noticed, this tends to cause two reactions.

1. The client suddenly feels concerned

OR

2. The client assumes it is because I think they are not capable.

This is not true.

Purchasing a home is very similar to planning a wedding. A home is one of the greatest investments you will make in your life, so you want to think things through so that you find the right fit for you. It is similar to searching for a venue, wedding dress, cake, etc.

You don’t just show up on the wedding day. You do your research, plan, and prepare wisely. Qualifying is just one step before the fun begins.

Jimmy Wakimoto, Vice President of Lending Operations at Civic Center Home Loans shares that…

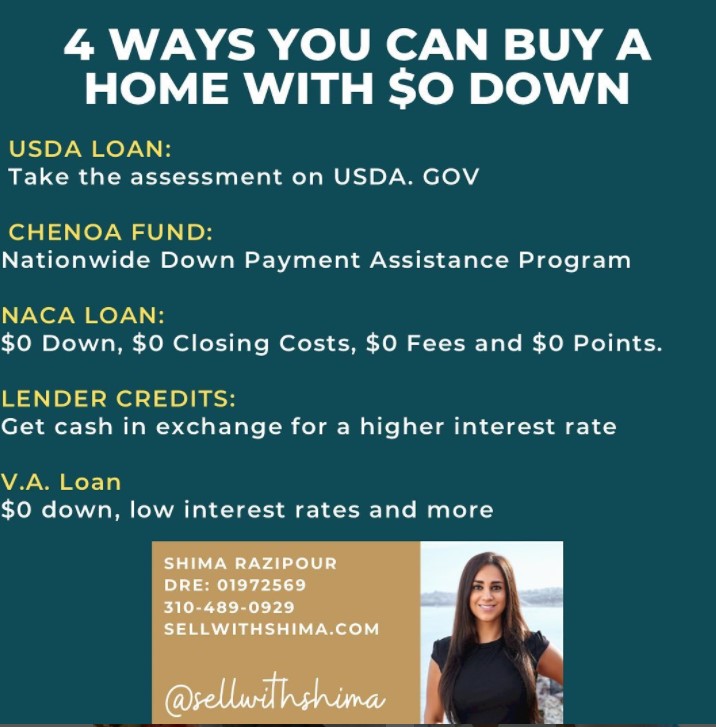

“It’s important to keep an open mind about what you believe to be fact about mortgage lending. For example, “Over 32% of Americans still believe that you need to have a 20% down payment to buy a home, even though that has not been true for over 30 years. In fact, some special programs allow you to buy without any down payment at all. There are a lot misconceptions out there about what it doable and what is not and it rules change very frequently. Don’t let incorrect information lead you down the wrong path, talk to a professional mortgage lender and get the facts.”

Even if you are not planning on purchasing a home for another year or so,

It doesn’t hurt to get qualified for 2 reasons:

1. You will need to it, eventually.

AND

2. If you discover your credit is in fact low, it may take 2-3 months to fix.

Getting qualified does not cost a dime. Wakimoto can determine what you qualify for by simply running a report for you.

Prior to a quick meeting with Jimmy, you will need to gather

-Paystubs or evidence of income for most recent one month period.

-ALLpages of statements (bank, 401K, investment, etc.) for the most recent TWO month period.

-W2’s/1099’s for the past 2 years.

-Copy of your Driver’s license and Social Security card

-2 years (Federal only NOT State) income tax returns.. ALL pages

Remember, you wouldn’t show up at the venue not knowing if your ring will be there. Get qualified today and expedite the home-buying process.

To learn more, please refer to Wakimoto’s wonderful website here.

ALTAR,

HOME BUYING,

INCOME,

JIMMY,

LICENSE,

LOANS,

PAYSTUB,

QUALIFICATION,

RING,

TAX,

WAKIMOTO,

WEDDING